It didn’t take long for the optimism of a new decade to wear off. By the end of Q1 2020, companies everywhere were reeling as they reckoned with the effects of the COVID-19 pandemic. Sadly, the impact of the virus was too much for many firms, leaving millions of workers unemployed and driving thousands of businesses to close their doors. Those companies that stayed afloat had to act quickly in order to enable their remote workforce and maintain operations.

Heading into 2021, there is little precedent for projecting the future. The economy is showing some signs of stability, but there are lingering fears over continued challenges or further surprises. Add in uncertainty around the U.S. political landscape, and there are more questions than answers.

Through all the confusion, though, there are still some basic concepts that will shape the year to come. Digital operations are more important than ever, with many transformative changes accelerating over the past year. Fair treatment for all is an absolute mandate, making diversity, equity and inclusion a top priority. The influence of technology is massive, forcing new approaches to regulatory behavior.

As the industry emerges from a chaotic year, it will begin a rebuilding phase, but this rebuilding goes beyond restoration. There is little opportunity to return to the old way of doing things. Thanks to changes that no one would have wished for and fueled by the requirements of a digital society, the technology industry will doubtless take a new shape in the coming year. This isn’t rebuilding to reclaim the past; this is rebuilding for the future.

Industry Overview

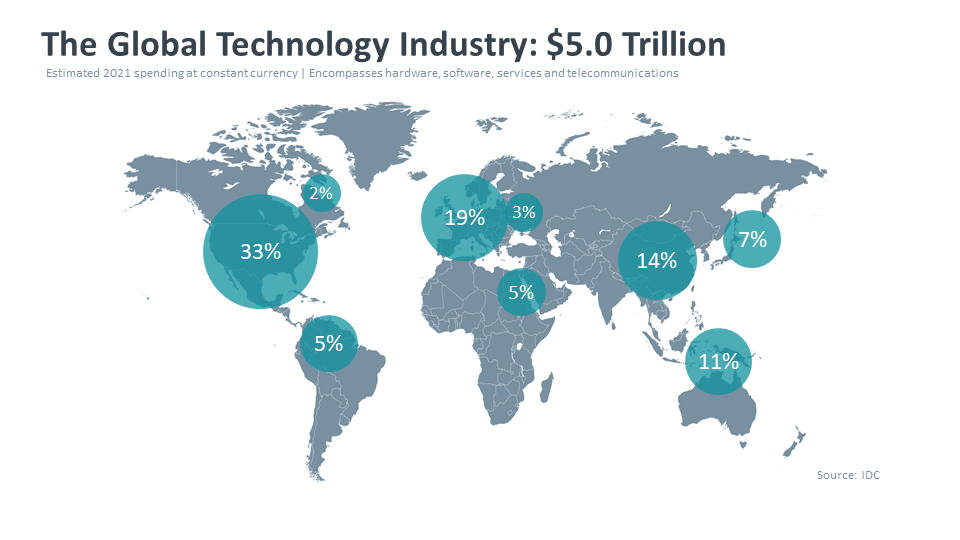

In 2020, the global information technology industry took a small step back in terms of overall revenue. As of August 2020, the research consultancy IDC was projecting global revenue of $4.8 trillion for the year, compared to their original estimate of $5.2 trillion. While the tech sector fared better than many other industries during the pandemic, it was not immune to cutbacks in spending patterns and deferment of major investments.

Moving forward, IDC projects that the technology industry is on pace to reach $5 trillion in 2021. If this number holds, it would represent 4.2% growth, signaling a return to the trend line that the industry was on prior to the pandemic. Looking even further into the future, IDC expects the pattern to continue, estimating a 5% compound annual growth rate (CAGR) for the industry through 2024.

The United States is the largest tech market in the world, representing 33% of the total, or approximately $1.6 trillion for 2021. In the U.S., as well as in many other countries, the tech sector accounts for a significant portion of economic activity. CompTIA’s Cyberstates report reveals that the economic impact of the U.S. tech sector, measured as a percentage of gross domestic product, exceeds that of most other industries, including notable sectors such as retail, construction and transportation.

Despite the size of the U.S. market, the majority of technology spending (67%) occurs beyond its borders. Spending is often correlated with factors such as population, GDP and market maturity. Among global regions, western Europe remains a significant contributor, accounting for approximately one of every five technology dollars spent worldwide. However, as far as individual countries go, China has clearly established itself as a major player in the global tech market. China has followed a pattern that can also be seen in developing regions, where there is a twofold effect of closing the gap in categories such as IT infrastructure, software and services, along with staking out leadership positions in emerging areas such as 5G and robotics.

The bulk of technology spending stems from purchases made by corporate or government entities. A smaller portion comes from household spending, including home-based businesses. With the blurring of work and personal life, especially in the small business space, it can be difficult to precisely classify certain types of technology purchases as being solely business or solely consumer.

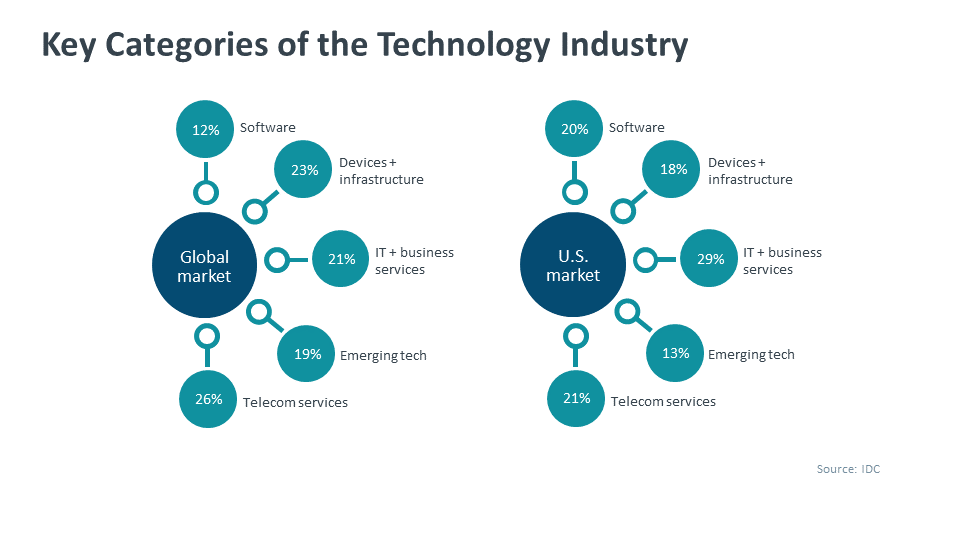

There are a number of taxonomies for depicting the information technology space. Using the conventional approach, the industry market can be categorized into five top level buckets. The traditional categories of hardware, software and services account for 56% of the global total. The other core category, telecom services, accounts for 26%. The remaining 19% covers various emerging technologies that either don’t fit into one of the traditional buckets or span multiple categories, which is the case for many emerging as-a-service solutions that include elements of hardware, software and service, such as IoT, drones and many automating technologies.

The allocation of spending will vary from country to country based on a number of factors. In the mature U.S. market, for example, there is robust infrastructure and platforms, a large installed base of users equipped with connected devices, and available bandwidth for these devices to communicate. This paves the way for investments in the software and services that sit on top of this foundation.

Tech services and software account for nearly half of spending in the U.S. technology market, significantly higher than the rate in many other global regions. Countries that are not quite as far along in these areas tend to allocate more spending to traditional hardware and telecom services. Building out infrastructure and developing a broad-based digital workforce does not happen overnight. Scenarios do exist, however, whereby those without legacy infrastructure – and the friction that often comes with transitioning from old to new – may find an easier path to jump directly to the latest generation of technologies.

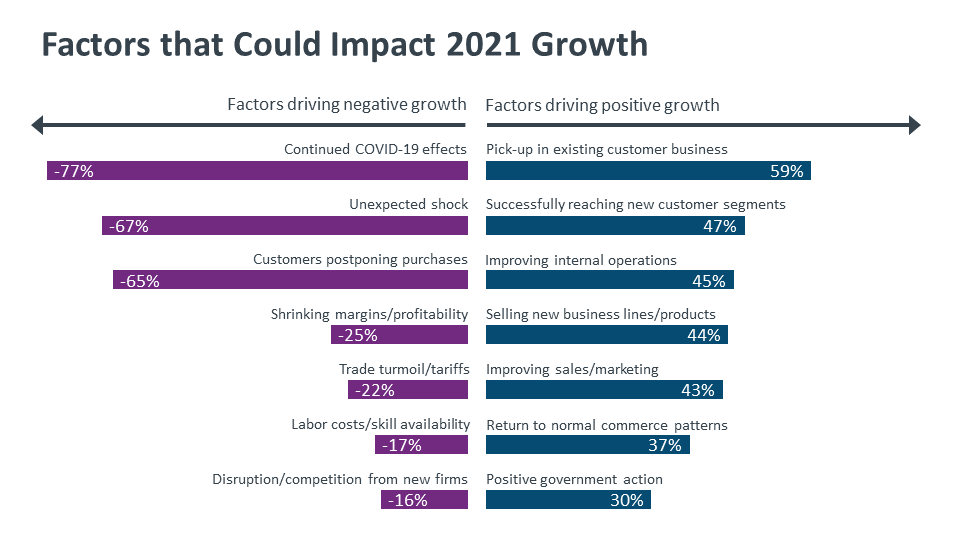

Although IDC is predicting a return to solid growth, the environment is more uncertain than any in recent memory. Several factors could swing actual spending in either direction. On the upside, technology firms are planning to capitalize on the ongoing digitalization of business, whether that is expanding engagements with their current customer base or reaching into new segments. Additionally, technology firms are applying lessons learned from a challenging year and placing the spotlight on their internal operations, including sales and marketing efforts.

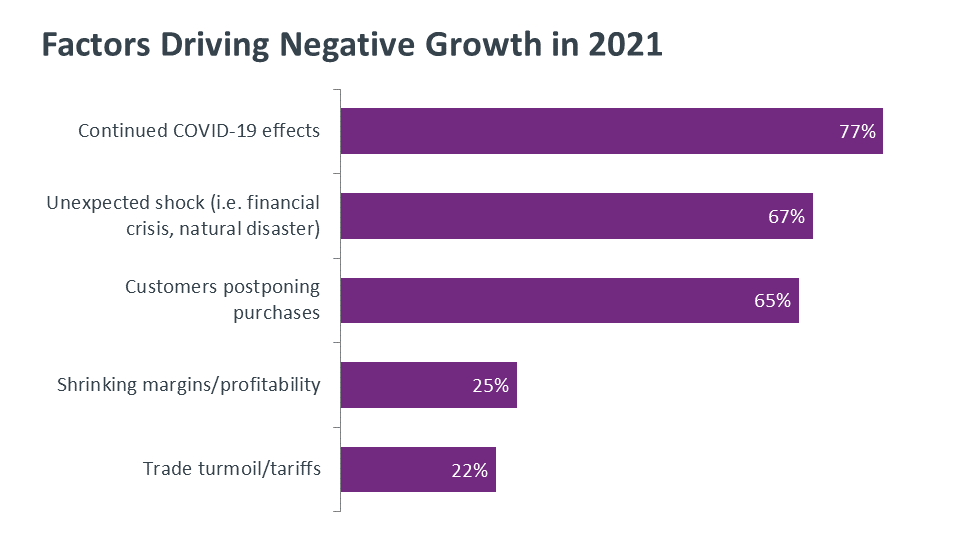

For the most part, negative sentiment is driven by uncertainty. Top of mind are any continued business struggles as the COVID epidemic drags on. Beyond that, the specter of some unexpected event feels more real after the events of last year. Ultimately, customers may postpone purchases or IT projects even further as they deal with uncertainty in their own space. Typical hurdles such as the availability of skills are still in the picture, but for most companies, the plans for 2021 are defined more by the unknown than quantifiable challenges.

The enormity of the industry is a function of many of the trends discussed in this report. Economies, jobs, and personal lives are becoming more digital, more connected and more automated—a trend that is only accelerating after recent events. The platform for computing has become much more stable, with access to technology no longer limited by location or constrained to certain activities. As a result, more energy is pouring into creative solutions, further expanding the opportunities for both IT professionals and IT channel firms.

These terms will feature in headlines throughout 2021, but the practical applications may be different from the hype.

- 5G: Featured everywhere from telecom carrier commercials to the new iPhone launch, this next generation of cellular networking will definitely add new platform potential, but disruptive applications still need to be built.

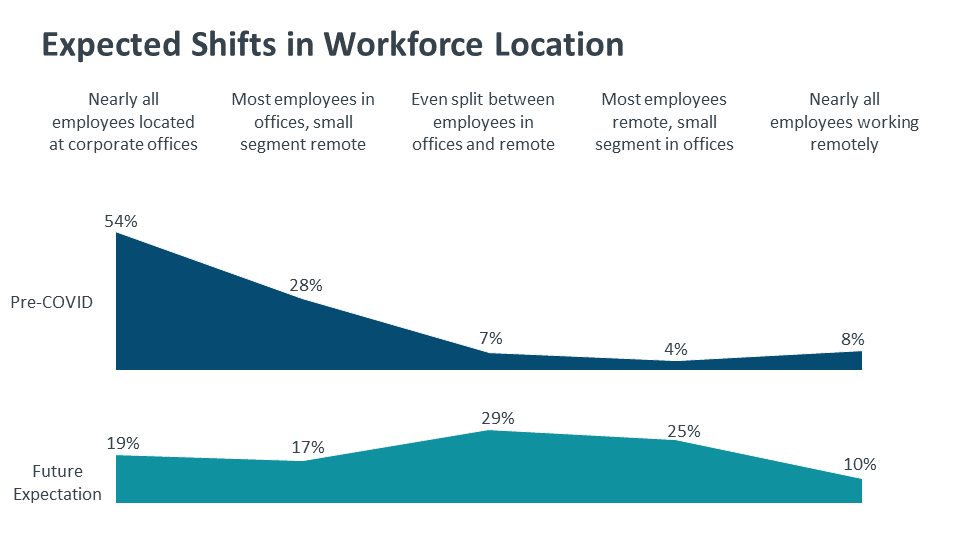

- Remote workforce: Every company had to embrace a remote workforce quickly, but it’s less clear how companies will handle the remote option when it’s not forced.

- Extended Reality (XR): This umbrella concept, including both virtual reality (VR) and augmented reality (AR), may advance beyond niche applications as the technology continues to improve and user behavior adapts.

- Robotic Process Automation (RPA): Thanks to a high degree of integration between individual systems and the use of new techniques such as machine learning and natural language processing, RPA is a key ingredient for many automation efforts.

- No code/low code: As software usage expands more and more, there are opportunities to use these simpler approaches that are less feature-rich but also require less technical skill, allowing rapid development by a wide range of users.

- Ambient computing: Sensors, wearables and natural language processing are some of the main ingredients in building systems that are integrated into everyday life and bring digital enhancements to common tasks.

- Social engineering: With humans as the weak link in the cybersecurity chain, cyber criminals are constructing attacks that leverage personal data to appear legitimate, leading to identity theft or additional data harvesting.

- Sustainability: Taking the concepts of Green IT to a new level, tech companies are placing a high priority on ensuring that their products and their operations have minimal impact on the environment.

IT PROFESSIONALS PLAY A PIVOTAL ROLE IN REBUILDING EFFORTS

For everything that changed in 2020, one thing that stayed the same was the importance of technology to business success. In fact, that importance grew as organizations had to quickly restructure their operations in order to support a remote workforce and improve flexibility and resiliency. Heading into 2021, there is no well-defined blueprint for the ongoing rebuilding effort, but it is certain that technology will continue to play a pivotal role.

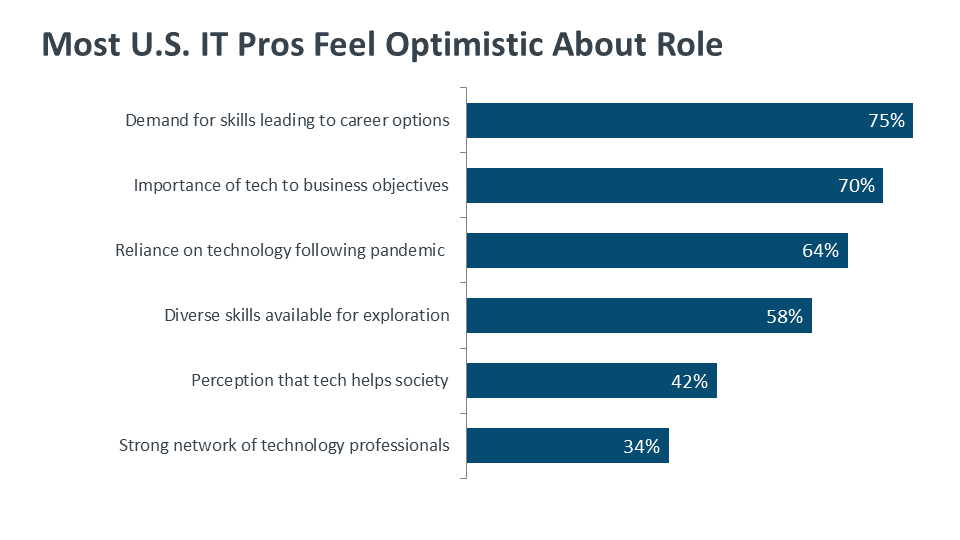

It is no surprise, then, that IT professionals overwhelmingly have a positive outlook for their job prospects. Nearly 80% of IT pros feel good about their role as a technologist, with 20% having mixed feelings and a very small minority feeling concerned. This represents a slight drop in sentiment from last year, with most of the shift going from the optimistic end of the scale into mixed feelings. Obviously, the current environment plays a major role—the leading case for pessimism is uncertainty around job security following the COVID pandemic.

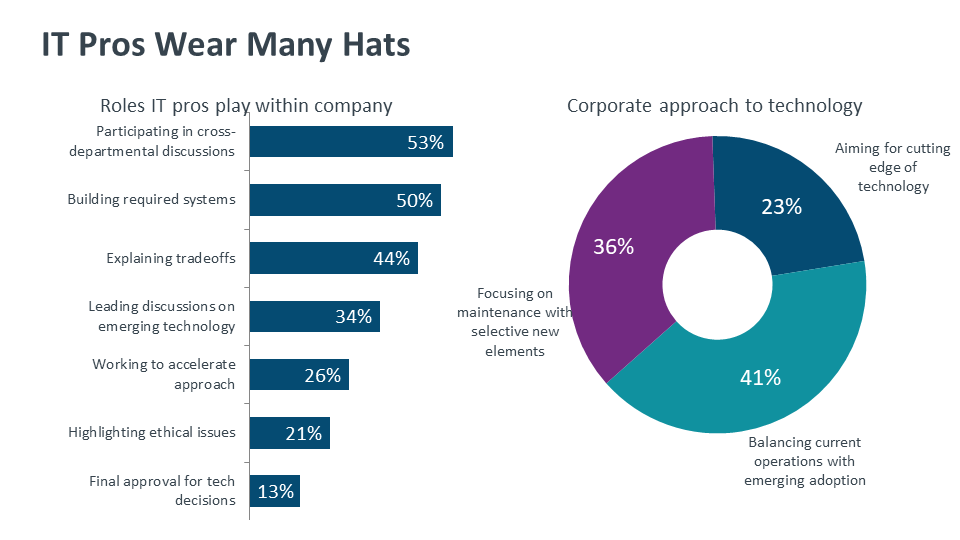

There are many more reasons for optimism, though. As with last year, IT pros see a bright outlook thanks to the high demand for skills, driven by the increasing importance of technology to business strategy. This dynamic has been in play for the past several years, as companies have moved away from a traditional mindset around tactical IT. In some ways, tactical IT will have a resurgence in 2021 as companies continue responding to needs highlighted during the pandemic. However, the long-term trends toward strategic thinking and digital transformation will be the primary forces impacting the technology function.

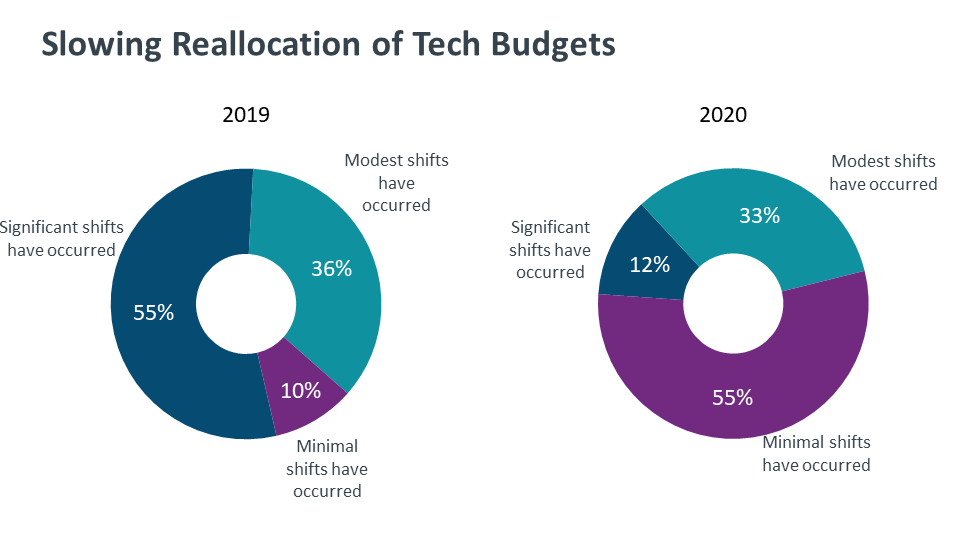

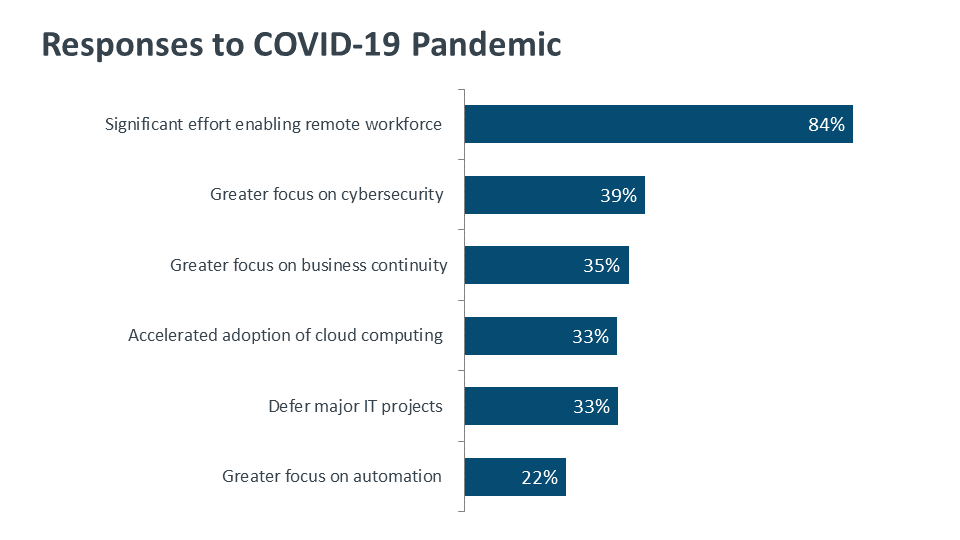

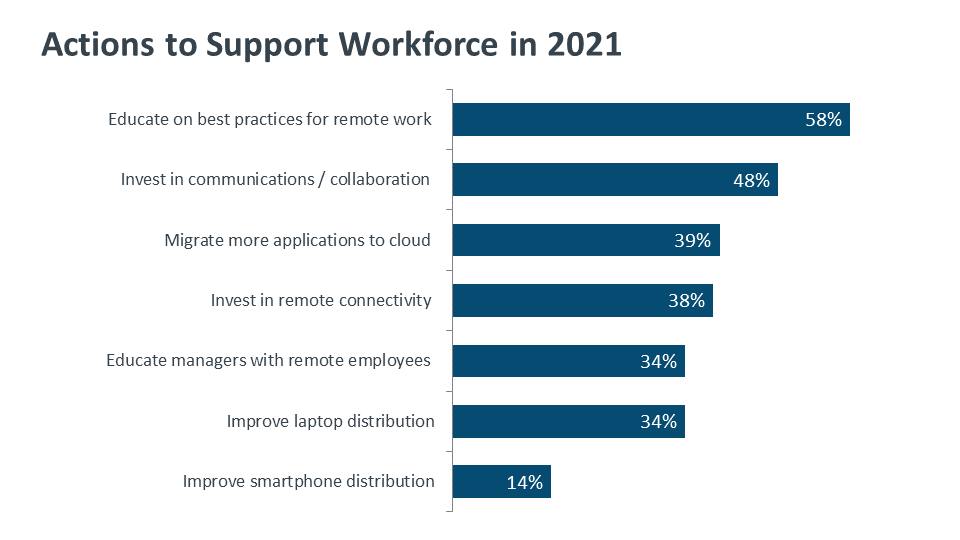

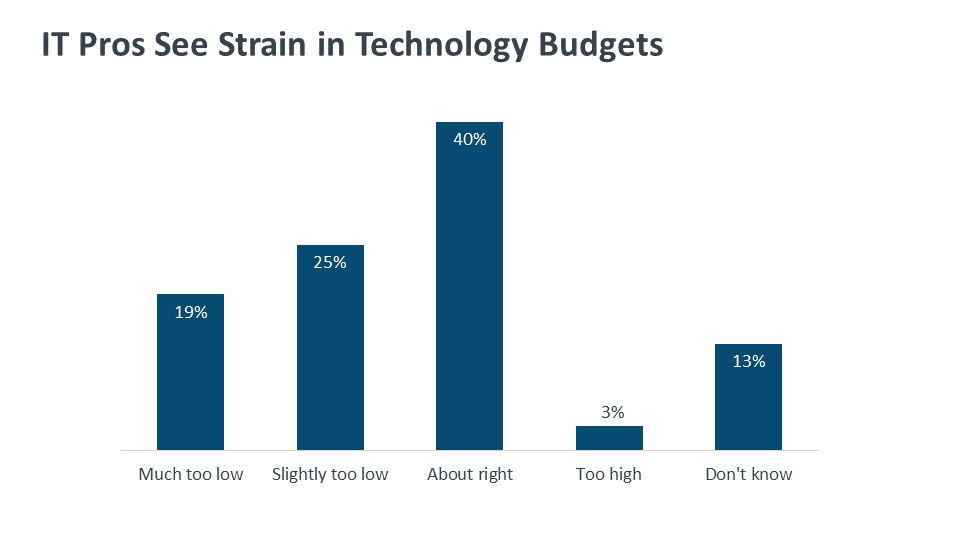

With both tactical and strategic needs in 2021, the big question for many IT teams is budget. The technology budget was already in flux, as the tactical cost center approach evolved into a strategic investment approach and technology spending was spread throughout an organization rather than being concentrated with the IT function. The pandemic created a budgetary shock wave, as companies had to instantly change plans. Some of the immediate responses created further challenges; while 84% of companies put significant effort into enabling their remote workforce, only 41% of companies placed more focus on cybersecurity. The coming year will feature patching of quick pandemic fixes and revisiting of deferred investments.

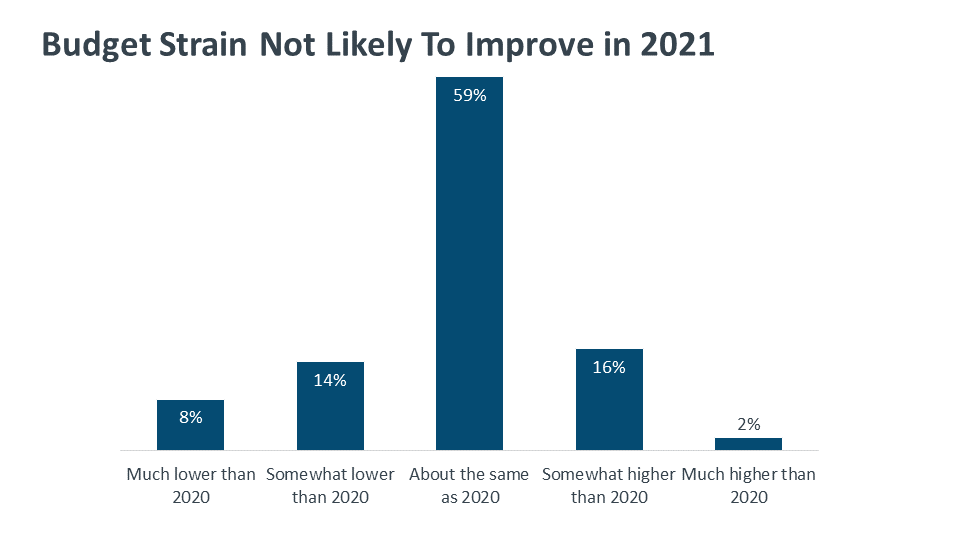

The budget tale for 2021 has two sides. On one hand, IT pros already felt like budgets were being strained, and that situation doesn’t seem to be improving. On the other hand, the silver lining is that most budgets aren’t getting cut, even in the face of austerity measures born out of crisis. Another stressor for IT pros as they consider the outlook for their role is the expectation of delivering larger results with a flat or shrinking budget, and the coming year will demand more innovation in building tech solutions to meet business goals.

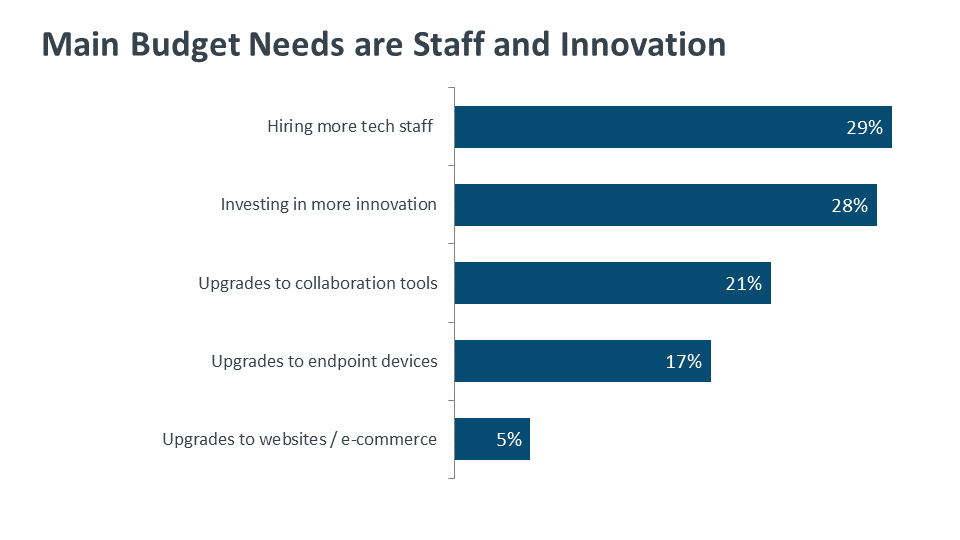

In the unlikely event that new dollars suddenly appear, there are two clear areas where IT pros see the need for additional investment. At first glance, hiring new staff would seem to be a straightforward way to solve the problem of doing more with less. The reality is more nuanced—the technology landscape has become incredibly complex, and new staff are more often needed to fill specialized roles rather than simply provide additional help.

The second main area of investment is in innovative, cutting-edge technology. The subtlety here is that the technology itself is not necessarily the objective. After years of emerging tech being in the spotlight, the pattern for adoption has become more clear. Individual technologies such as IoT or AI are not purchased and implemented directly. Instead, these trends factor into broader strategies that benefit a company’s operation, such as automation or product development.

Looking deeper at skills, the IT workforce keeps evolving from a heavy focus on infrastructure and generalists into a diverse world of specialists spread across four fundamental disciplines. CompTIA’s IT framework defines infrastructure, software development, cybersecurity and data as the pillars supporting IT operations. Looking at each area individually highlights the layers of complexity that companies are dealing with as they try to build the best skills within their workforce.

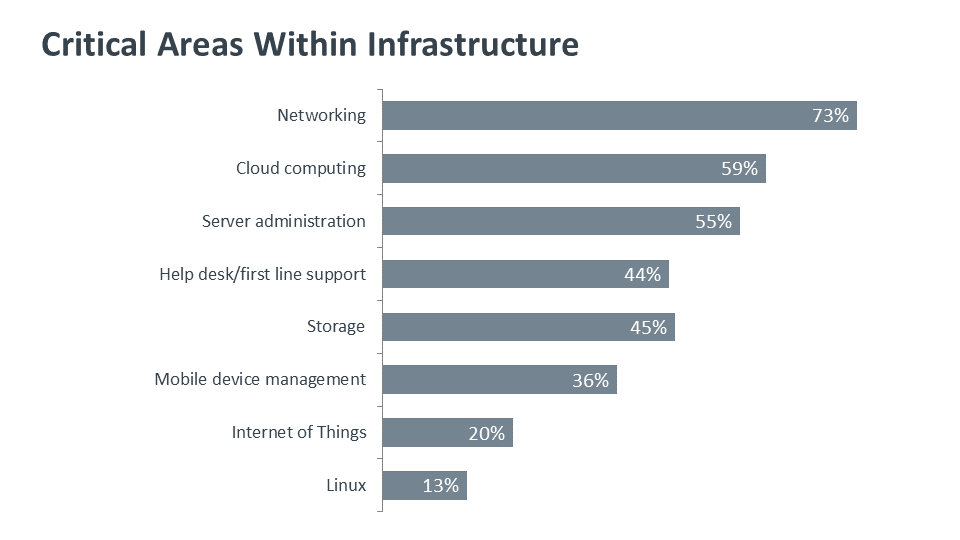

Starting with infrastructure, most companies look to be getting back to basics in the year ahead. This has been true in the past as well, but this year the demands around fundamental pieces are even more pronounced given the focus on resilient systems. As companies place more of their IT architecture in the cloud and consider new options for their workforce, networking performance becomes more critical. Other backend components such as server administration and storage are also part of a broader modernization of the IT building blocks. Nearly half of all companies are placing focus on first-line support, proving that the help desk has still not become a commodity in an age of outsourcing and end user tech savvy. Although the emerging area of IoT was not a major priority last year, it still takes a small step back as companies concentrate more on core operations and less on advanced techniques.

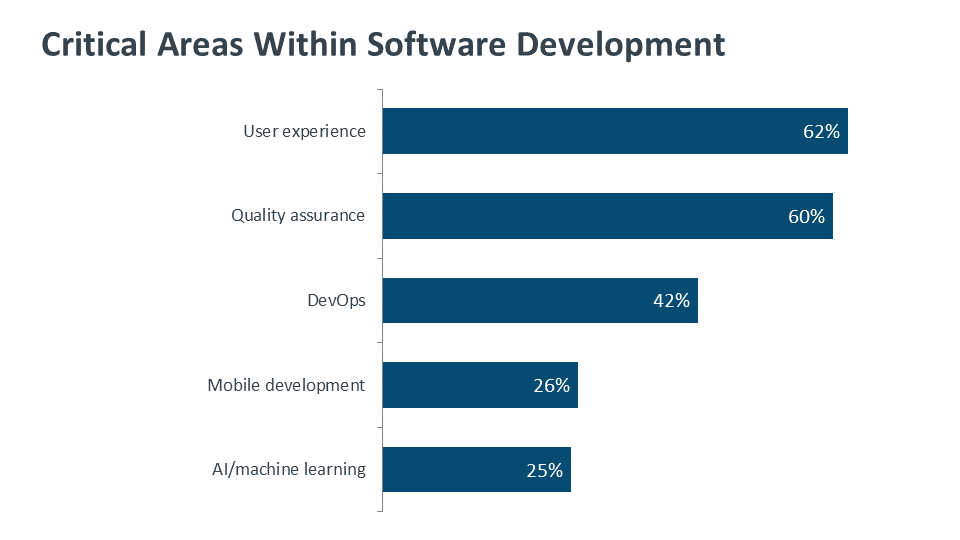

There is no change in the top two focus areas for software development. Whether dealing with internal stakeholders or external customers, companies continue to emphasize user experience. The app approach that became widespread with the explosion of mobile devices redefined expectations around software usability, and many companies are still climbing the learning curve. The need for quality assurance is tied to the speed of development cycles, as organizations are trying to accelerate their processes without disrupting workflow. This acceleration leads to an overall focus on DevOps, which sees a significant increase in attention over last year. Although infrastructure projects may command more time and energy in 2021, the general direction will be toward more investment in software development for customization and automation. As companies build out their software capabilities, they will drive more interaction between software development and infrastructure operations. The lack of focus on AI and mobile development is less due to a shift away from long-term projects and more due to the fact that many companies do not need these specializations as core competencies.

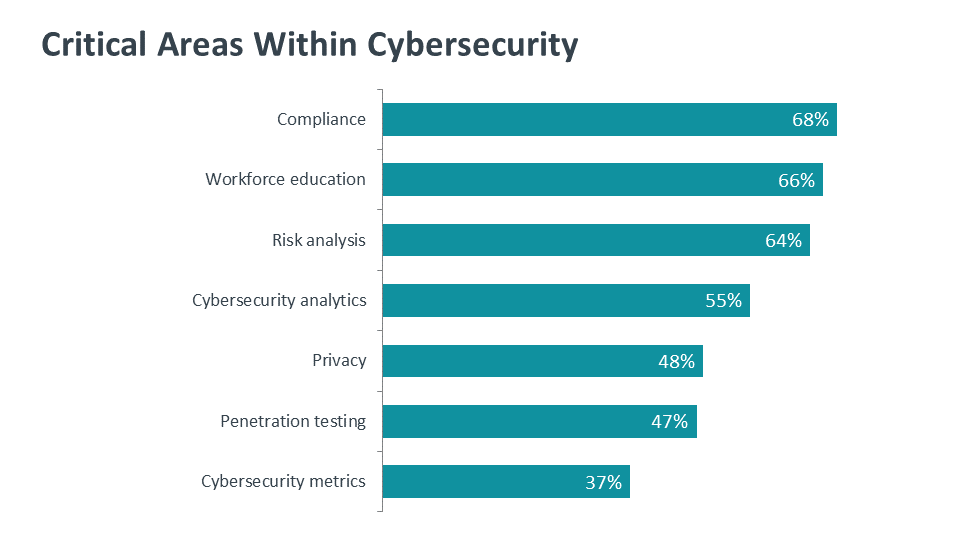

Cybersecurity is possibly the most complex of the four pillars, covering expanded defenses that companies must build, innovative approaches to proactively test those defenses, and internal processes that create secure operations. It is somewhat surprising to see such a high focus placed on compliance for the coming year. While the technology industry is heading toward more regulation, many companies have been somewhat slow to fully embrace compliance processes. Workforce education also moved up in the list, but that is more understandable. New concerns that stem from a remote workforce have been a primary trigger for both security awareness education and security investments. Risk analysis, cybersecurity analytics, and penetration testing are all areas that need improvement as companies adopt a zero trust mindset. Cybersecurity metrics rank lowest for the coming year, which signals the ongoing challenge in bridging the gap between cybersecurity best practices and business health.

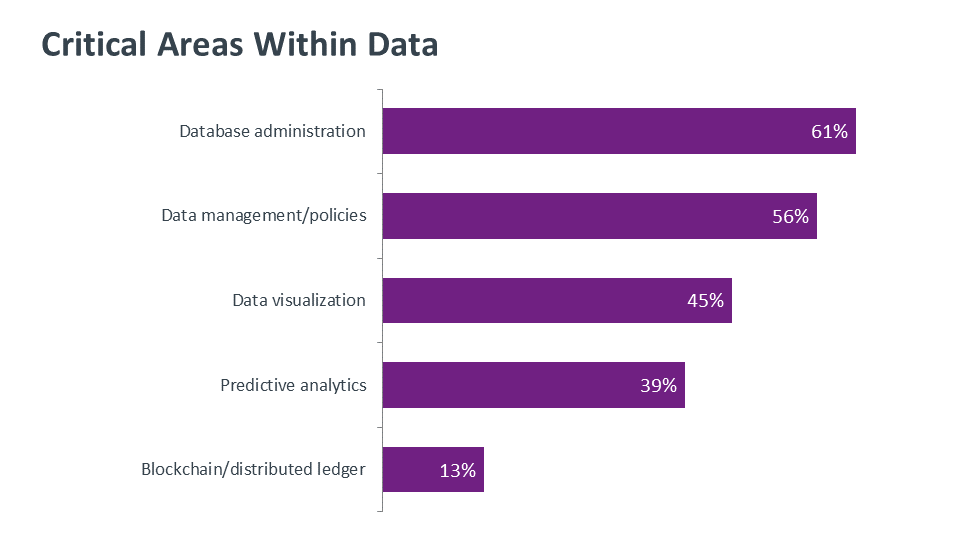

Finally, the field of data is not set up to be a dedicated function as often as cybersecurity, but it is still a field where businesses are trying to establish comprehensive policies and management. Database administration is still the top focus area heading into 2021, as many companies continue to move away from spreadsheets and other simplistic forms of data management. The emphasis on data management and policies shows that businesses are beginning to take a more comprehensive approach to their data, which in turn will drive more specialization. While data visualization and predictive analytics have relatively strong demand, those areas are still difficult to tackle without a holistic data management strategy. As far as cutting-edge technologies, distributed ledgers such as blockchain have tremendous potential, but there are still hurdles in implementation and the technology will most likely remain a degree separated from most end users.

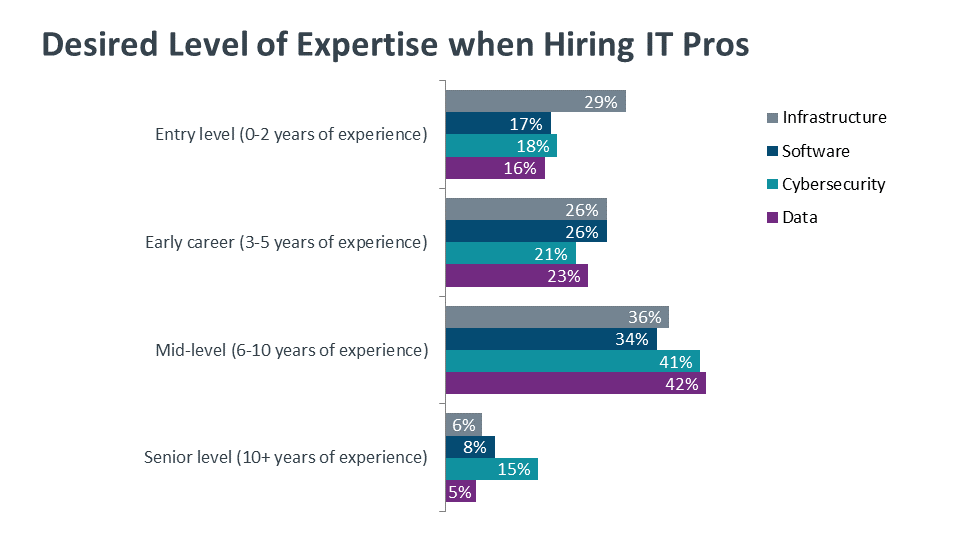

Adding to the challenge of filling a broad range of skills, companies are generally looking for candidates with deeper expertise. Across all four IT pillars, hiring companies are primarily targeting either early career (3-5 years of experience) or mid-level (6-10 years of experience). The one standout is infrastructure, where firms also have high interest in entry-level positions. The focus on a higher level of experience may make sense in the areas of infrastructure and software development, where businesses have likely built a hierarchy of skills over time. For cybersecurity and data, the situation is more complicated. These areas, which have traditionally been subsets of infrastructure and development, have relied on those foundational pillars to provide the entry level skills. Now that they are distinct functions, there are difficulties in creating the pipeline for more advanced talent. Over time, entry-level positions will likely emerge, but in the meantime, companies will have to explore different avenues for filling their skill gaps.

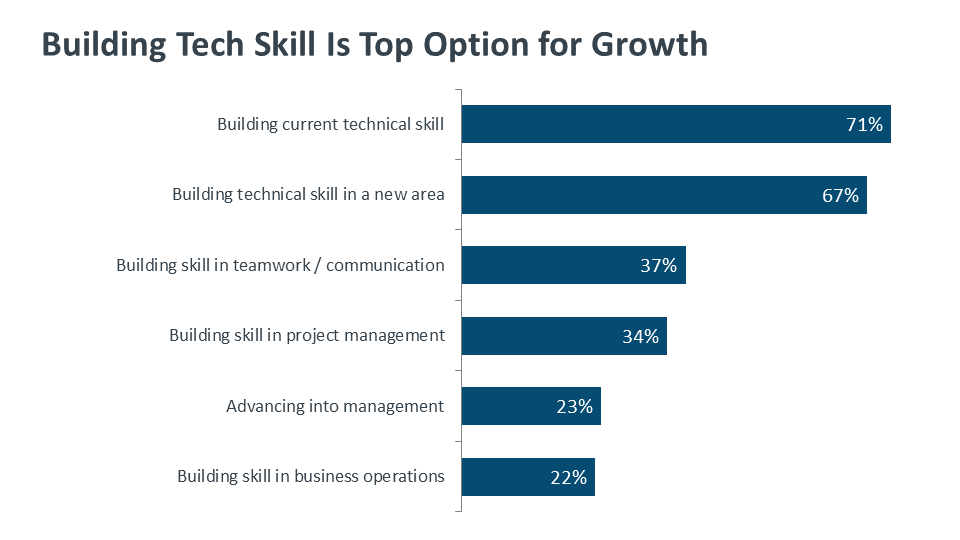

Thanks to these pipeline challenges, hiring is lower on the priority list for companies in the upcoming year. Instead, there will be a strong focus on training and certifying the employees that are already on board. Only 37% of companies expect to bring on new headcount in 2021, compared to 75% that plan on pursuing training options and 54% that plan on certifying their workforce. When it comes to career growth, there are three distinct areas IT pros expect to develop. First is technical skill within their existing specialization. With so many different topics within each pillar, there is plenty of room for growth. Second is technical skill in a new area. The four pillars interact in unique ways, and these overlaps define how business solutions are built and maintained. The final focus area for career growth is project management, going beyond the technical interactions to handle scheduling, deliverables, and tradeoffs.

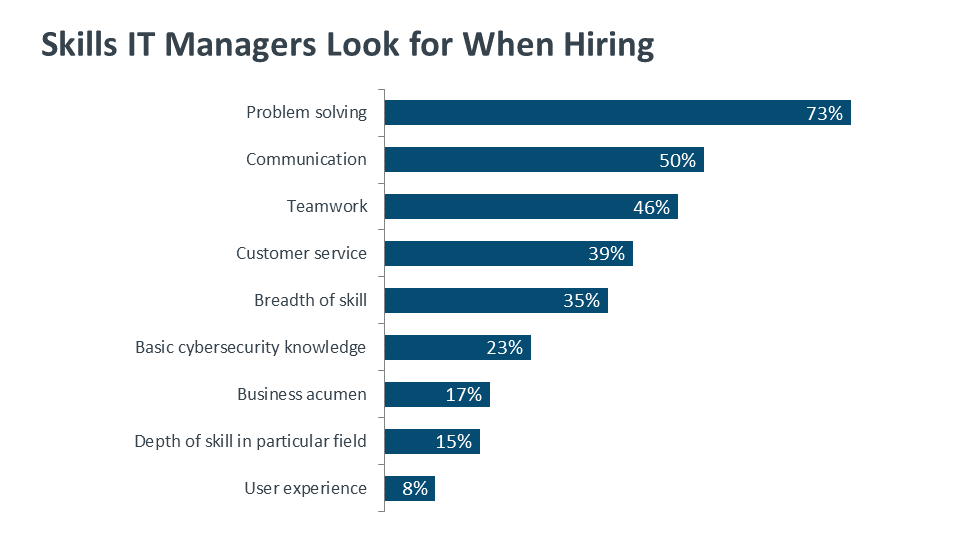

Following an incredibly difficult year, IT pros head into 2021 with uncertainty but also with optimism. The uncertainty comes from an unsteady environment and the questions that most employees have around the future. The optimism comes from knowing that the future will be digital. There has never been more demand for technical skills, but it is also critical to remember that businesses need guidance in a digital world. Staying up to date on technology will help IT pros build advanced solutions, while improving business acumen and communication skills will help them influence the strategy that uses those solutions.

THE BUSINESS OF TECHNOLOGY POSITIONED FOR EVEN GREATER INFLUENCE

Much like IT professionals, companies in the business of technology (aka the channel) are also facing a host of opportunities, challenges and change in the year ahead. Clearly, 2020 has been a year like no other for many of the small businesses that comprise the majority of the channel. Some firms have taken a serious economic hit due to the COVID-19 pandemic, including some that have gone out of business. Other channel firms have found opportunity in various silver linings that have come from activities such as supporting the technology needs required in the massive move to remote working, for example. What bodes for 2021 is still not entirely apparent, but many channel firms remain cautiously optimistic, some even bullish.

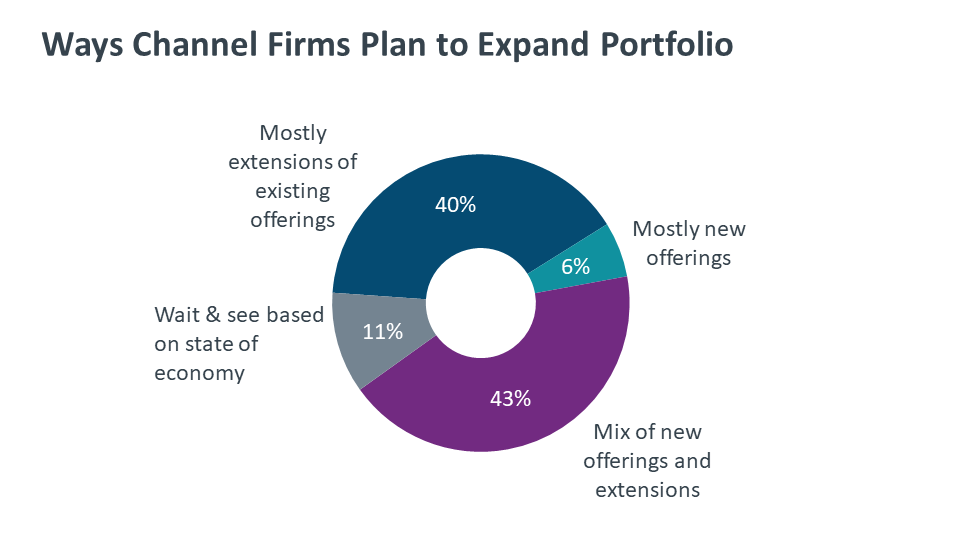

At a general level, many things haven’t changed for the channel. Technology and the business of selling it continues to grow more complex. What was once a fairly stable set of infrastructure products in a channel provider’s portfolio has, in the cloud age, morphed into myriad choices around software-as-a-service applications, data tools and a stack of emerging technologies. This, of course, is a far cry from straight-up hardware device sales. Additionally, business and tech consulting and pure influencing roles have been rapidly establishing themselves as legitimate – often lucrative – channel business models.

Looking ahead to 2021, firms that manage to thrive will be making investments in skills training, expanding their market reach to new customers and verticals, partnering with potential competitors, and embracing emerging tech. For many, that means getting out of their comfort zone.

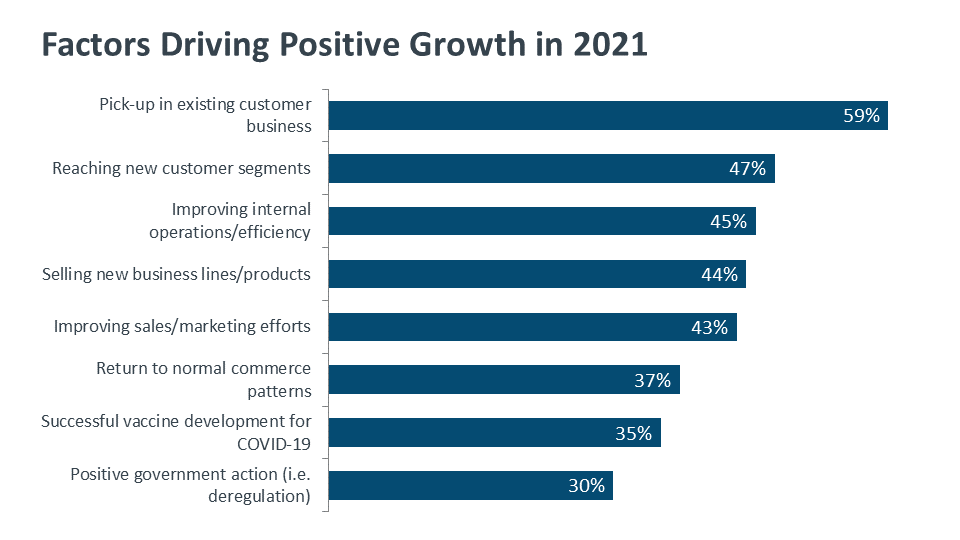

To ensure positive growth in 2021, channel firms are first looking to rely on what they already have. The No. 1 factor respondents say will move the needle optimistically next year is a pick-up in business from existing clients. This makes sense in the current economic climate where finding new customers may be challenging, considering that many of the SMB customers the channel targets have been existing in cost-cutting or frozen-budget mode during the pandemic. That said, mining existing customers for additional revenue rings especially true with managed services providers for whom upselling additional types or tiers of services is often the key to growing revenue and profit margin.

Other areas where firms place value include reaching new customer segments. Opportunities there range from enticing new clients with any of the emerging technology solutions on the market to offering up a specialization in a particular industry vertical. Four in 10 respondents said they’d choose to specialize in a vertical if they could do so today. From a practical perspective, companies also see potential benefit in the year ahead from streamlining their operations internally. Process efficiency and cost containment, while not the most exciting, are necessary for optimal profitability. They also represent best practices to enforce before investing in new market expansion and new customer acquisition. Running a tight ship took on new meaning in this past year and is likely to continue well into 2021.

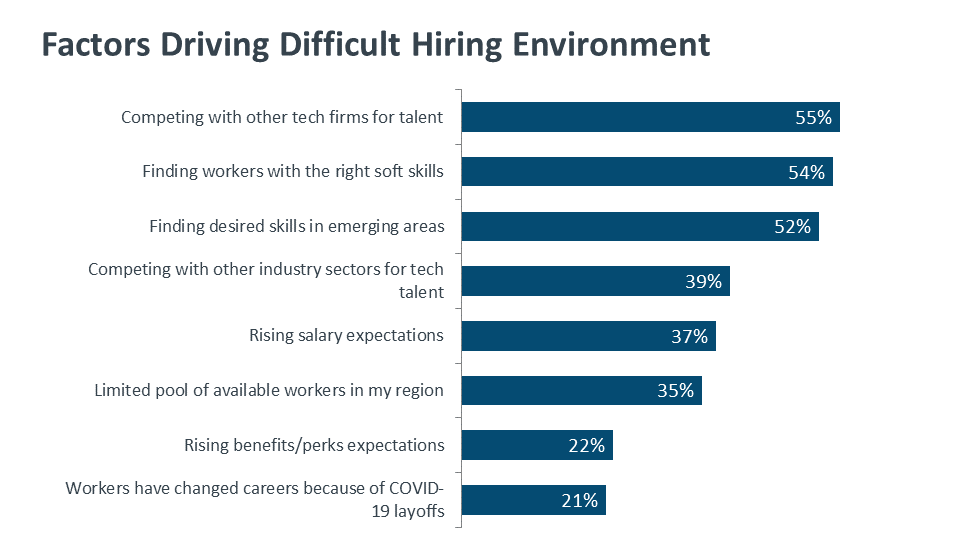

What could derail 2021? There’s one primary answer: continued effects of COVID-19. Last year, the channel’s top worries were labor costs and the ability to hire employees with skills that map to today’s complex technology demands, including emerging tech acumen. This year, it’s all about outside forces, whether it is the virus and its impact on business viability, especially in the case of additional lockdowns, or other unexpected factors such as natural disasters or an unforeseen, non-COVID-related financial crisis. Channel firms also worry about customers pumping the brakes on purchasing, which typically correlates to overall market conditions.

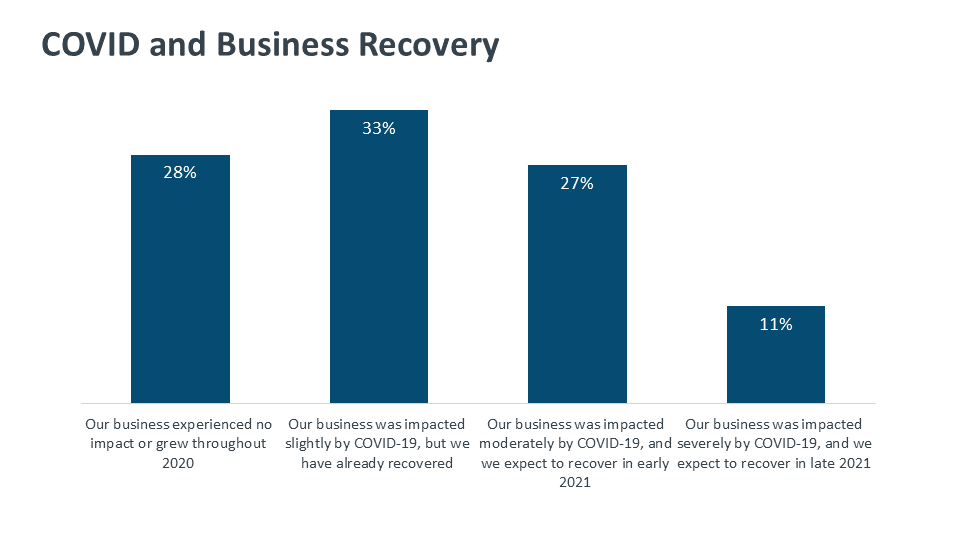

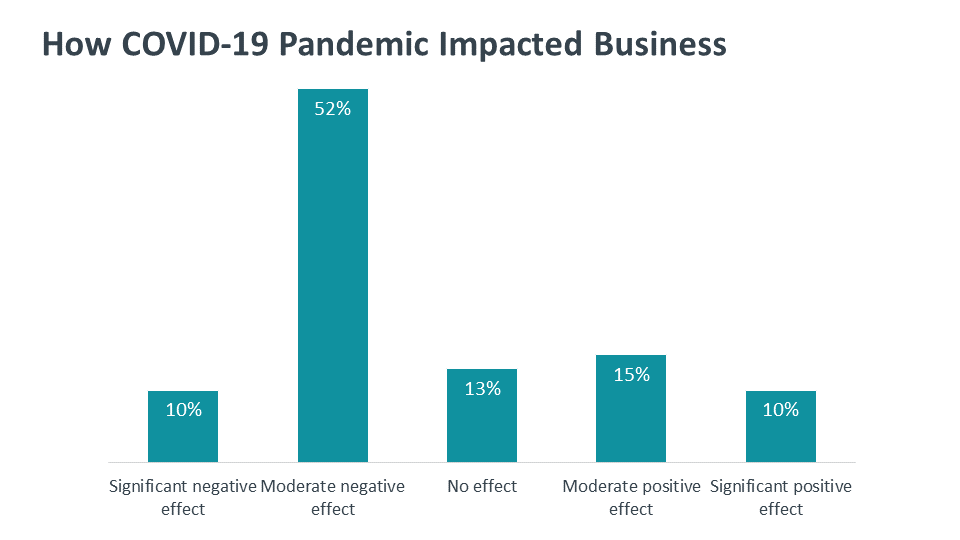

The effect COVID-19 has had on business in the channel is undeniable, with roughly half of companies reporting some downside impact in the past year. Smaller firms are more likely than larger to have been affected, given that their customer base also tends to be in the SMB space, a demographic most negatively hurt by business lockdowns and restrictions on capacity (think restaurants and other hospitality-oriented outfits). But a recent study by McKinsey also shows that the pandemic has accelerated digitalization efforts by many companies, especially as they relate to interactions with customers. This phenomenon, along with the aforementioned need to support the shift to remote work, provides some clear avenues of opportunity for channel firms looking to assist customers in these efforts.

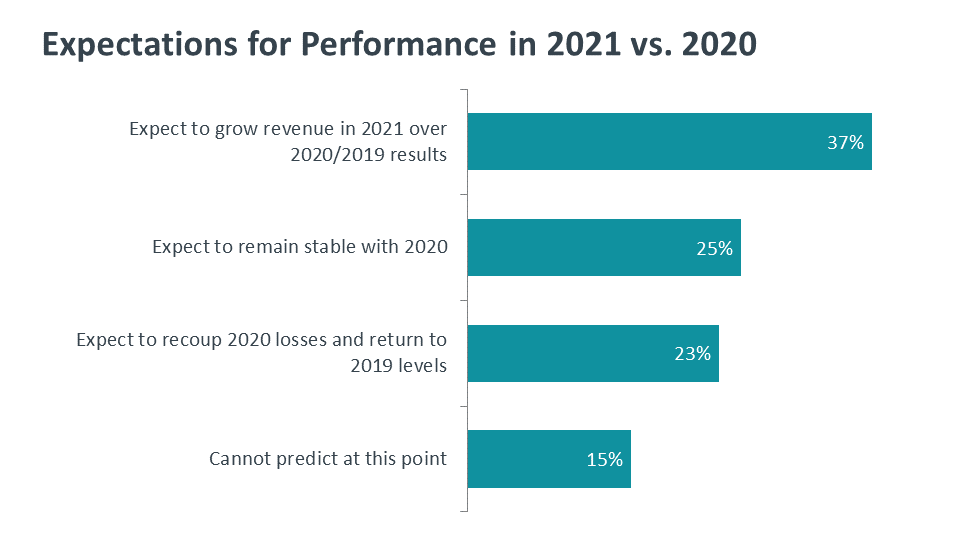

From a revenue perspective, fingers are crossed. The half glass full crowd (37%) expect that they will grow revenue in 2021 in excess of both 2020 and 2019 results. Another quarter expects to remain stable with 2020, though that could be a revenue level that was less than 2019 for those firms. Nearly another quarter of respondents acknowledge that 2020 led to lost revenue, but they predict a return to 2019 levels this coming year. The optimism is likely predicated on a number of factors. Many channel firms are pivoting to services-based businesses, emerging tech opportunities, and verticals, while at the same time taking advantage of some of the new needs of the pandemic work environment. Other firms are doubling down on what is now even more critical than ever: security expertise.

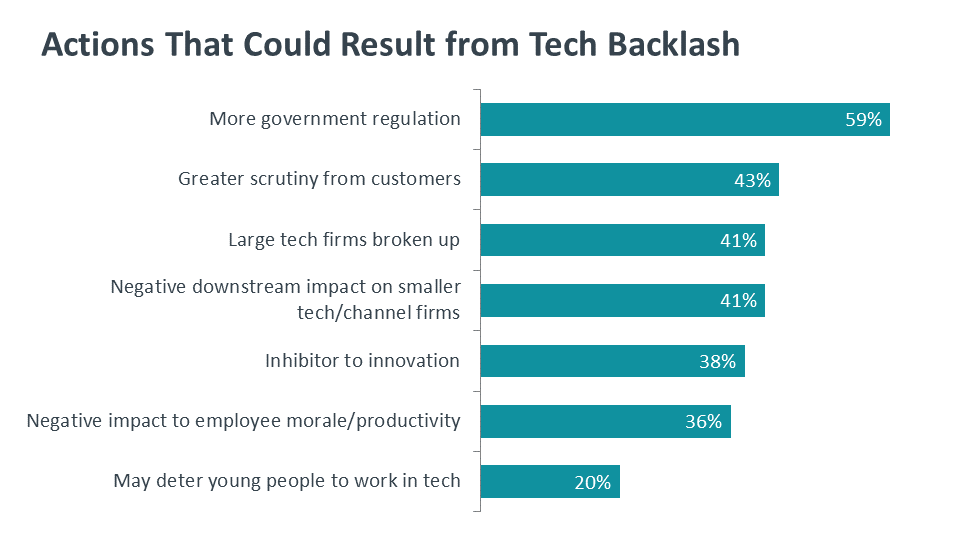

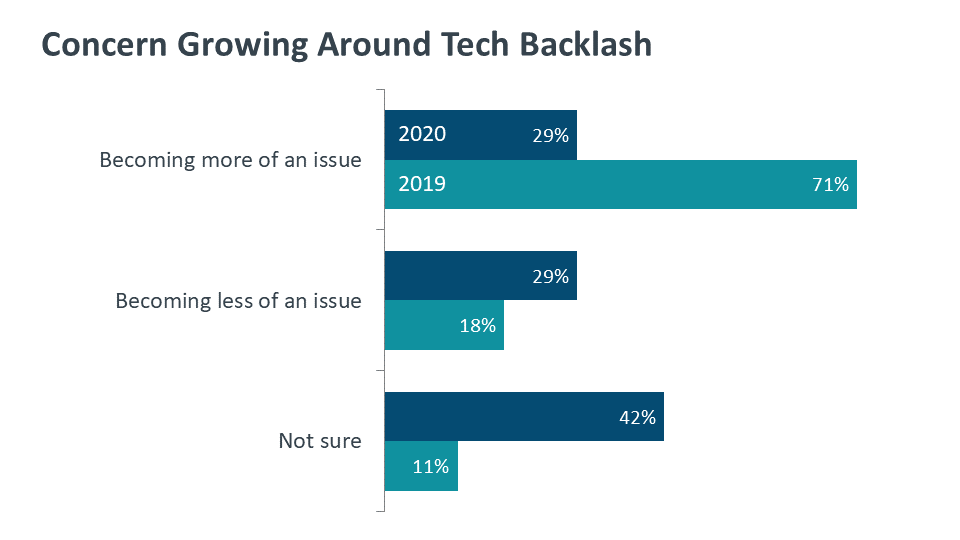

Last year, many channel firms worried that the negative news about the broader technology industry would result in “techlash” that could have a downstream effect on their businesses in terms of regulation and the stifling of innovation. Seven in 10 channel firms said backlash against the tech industry was becoming more of an issue. At the time, privacy violations, data breaches, social media-enabled election interference and other controversies had thrust the industry, and many of its leading corporations, into the media spotlight and the government’s watchdog lens. And that’s still true today – to a degree. Titans of tech, particularly social media CEOs, continue to be taken to task in Washington, D.C. by government officials for any variety of real or perceived offenses. But the media attention on this is far dimmer than in 2019, overshadowed by the pandemic and its impact. The resulting “recency bias” may account for respondents seeming to be much less concerned about techlash this past year than in 2019. They are simply not hearing about it as much.

That said, companies in the business of technology, while perhaps not fretting nearly as much this year, still raise some concerns about how the actions of the larger technology companies could spill out over the entire industry. Six in 10 cite more government regulation as a potential issue, while 43% fear greater scrutiny from customers, presumably just because their business is in the tech sector. (See Appendix for more)

One of the key questions to think about heading into 2021 is how to budget. More than last year? Less? The same? Given the volatility of 2020, annual budgeting is a top of mind issue for many channel firms as they attempt to forecast sales, ponder new markets, or fight to keep their business afloat.

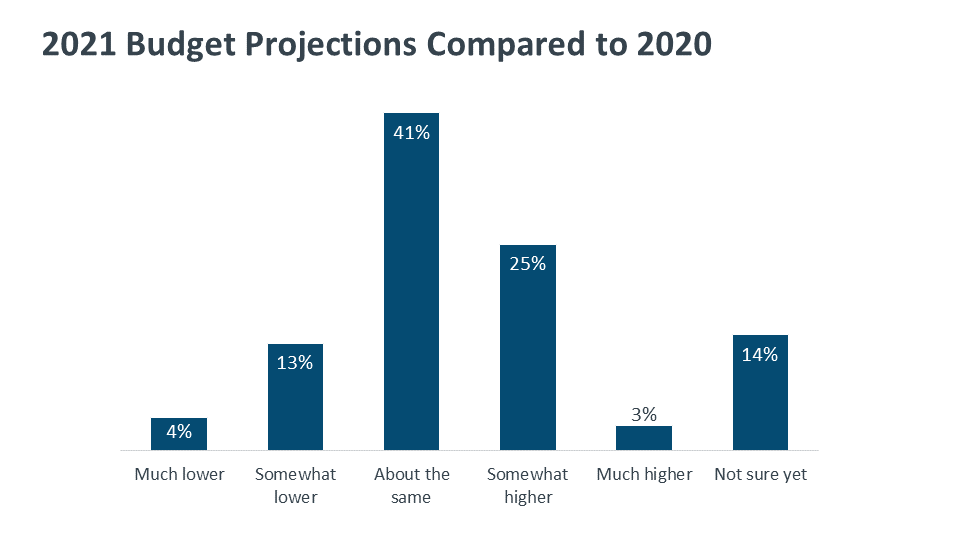

The approach taken to budgeting for 2021 would fall into the cautious optimism category. Four in 10 anticipate keeping funding at 2020 levels, with a quarter predicting somewhat higher allocation and 13% somewhat lower. On the far extremes – much higher or much lower – the percentages are only in single digits. It seems many firms are playing it safe. Budgets, after all, can be adjusted as the year goes on, depending on circumstances positive or negative. Another sign of the uncertain times, 14% of companies report not being sure yet about their budget projections for 2021, indicative of the difficulty of forecasting accurately right now.

Respondents have some clear opinions on what department areas are getting sufficient allocation in the overall budget versus those areas that could use more or less. Sales, marketing, and oddly tech support rate highest as areas being slightly underfunded. Marketing is an obvious one; for many channel firms it has always lagged in both resources and general attention. Few channel firms – though this is changing – employ a full-time marketing staffer, and the discipline itself has often been overlooked.

Interestingly, 31% of channel firms feel that the budget for tech support within their organization is too low. This is somewhat puzzling given that these are technology firms whose presumed mission is to provide support, technical advice and consulting to customers. One would assume this would be a highly funded area. It’s possible that these responses reflect the impact of job cuts due to the pandemic, or, more positively, are indicative of a rise in customer demand that has pinched tech support teams’ capacity, leading to a call for more headcount or other resource help.

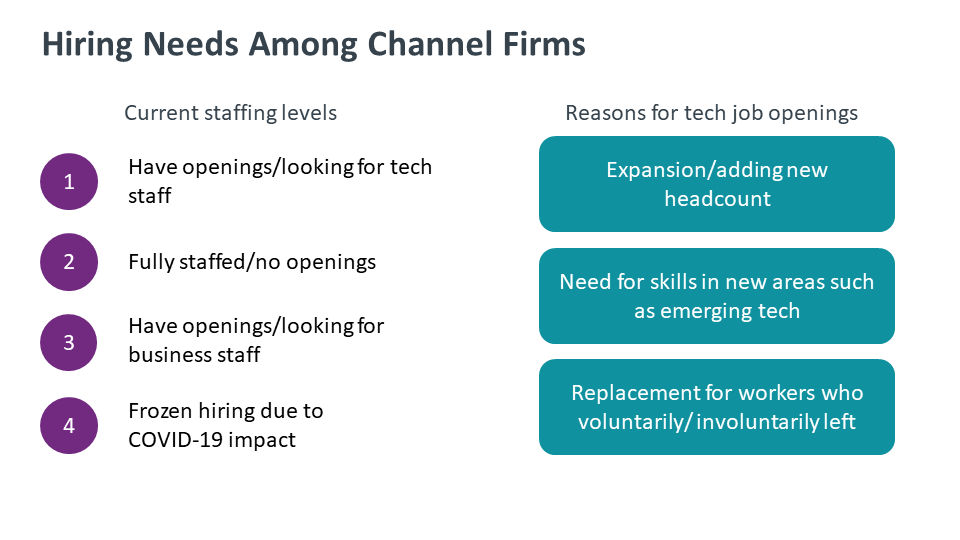

Along with budgeting comes the human factor: staffing, skills gaps, etc. Despite current pandemic conditions, many channel firms are nonetheless on the hunt for new employees, particularly those with skills in certain areas such as emerging tech (IoT, AI, etc.) as well as business acumen for sales and marketing positions. Nearly 4 in 10 firms report having current openings they are actively looking to fill in technology roles, while 15% are angling to shore up their business-related employee base. Twenty-eight percent are fully staffed at present, while 13% said they in a hiring freeze directly related to COVID-19’s impact.

The business model, technology focus, and type of customers served will greatly influence the staffing needs of the typical channel firm. For example, a managed services provider may well need more tech staffing now that a majority of its customers are working from home instead of a central office location. Other companies are grappling to fill staffing holes because some of their employees needed to leave the workforce to tend to school-age children at home during the pandemic. Other channel firms are using their solid financial base and positive cash flow to dive into new markets and grow during this uncertain time.

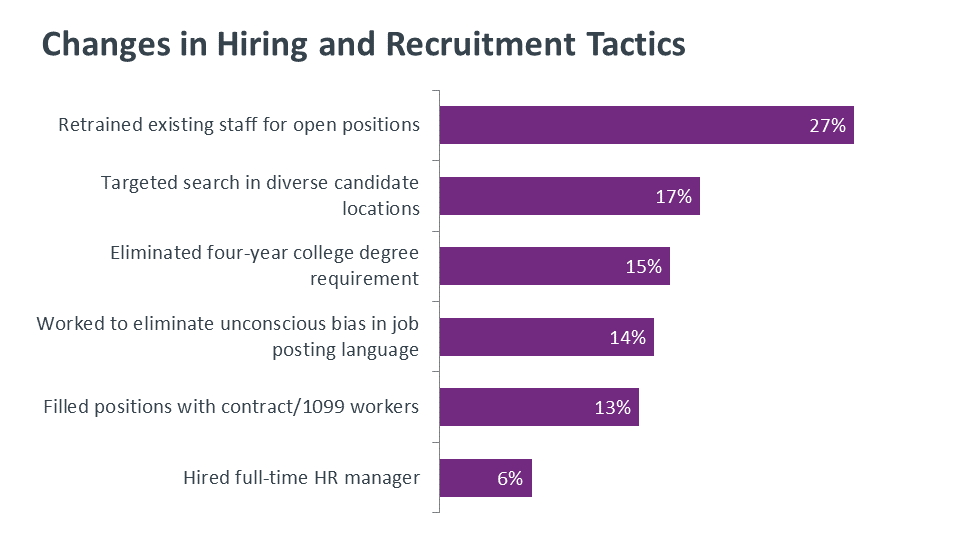

For many firms, hiring from outside is not their path. Three in 10 channel firms are retraining existing staff for open positions or to address new areas of focus, for example. For those hiring externally, some are conducting recruitment efforts that seek out a more diverse applicant pool. Others have eliminated the four-year college degree requirement altogether, focusing instead on skills aptitude and culture fit.

Appendix

About CompTIA

The Computing Technology Industry Association (CompTIA) is a leading voice and advocate for the $5 trillion global information technology ecosystem and more than 50 million industry and tech professionals who design, implement, manage and safeguard the technology that powers the world’s economy. Through education, training, certifications, philanthropy, and market research, CompTIA is the hub for advancing the tech industry and its workforce.

About this Report

CompTIA’s IT Industry Outlook 2021 provides insight into the trends shaping the industry, its workforce and its business models. Because trends do not occur in a vacuum, the report provides context through market sizing, workforce dynamics, and other references to supporting data. The interrelated nature of technology – where elements of infrastructure, software, data and services come together—means trends tend to unfold in a step-like manner. A breakthrough may lead to a notable advance, which may then be followed by what could be perceived as lateral movement as the other inputs catch-up. Some of the trends highlighted in this report focus on an early stage facet of a trend, while others recognize a trend moving beyond buzzword to reach a certain stage of market-ready maturity. As such, the timing of trend impact may vary from reader to reader depending on company type, job role or country. Lastly, this report is not meant to cover every trend in the industry. Other trends are covered in additional CompTIA research. Visit www.CompTIA.org for past versions of the IT Industry Outlook and an extensive library of research and educational content.